Market Update - 4th May 2024

Written by William Cooper

Domestic Market:

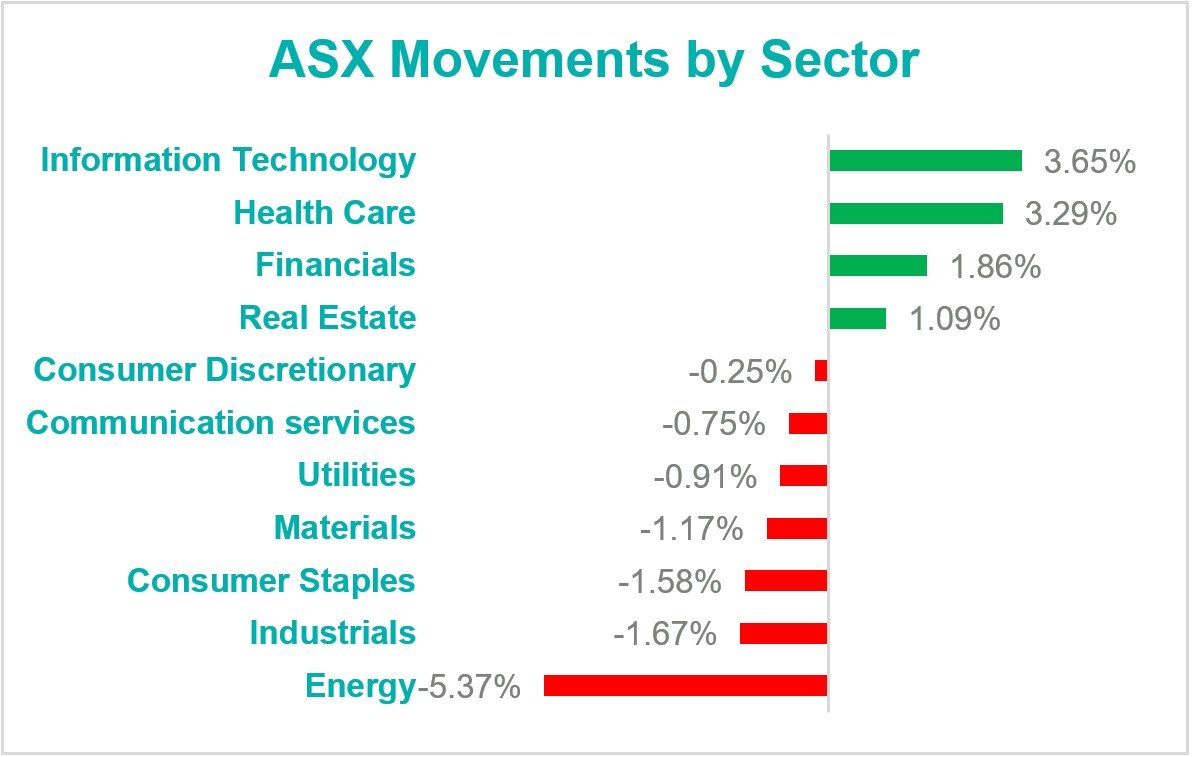

After attempting to bounce back from last fortnight’s horror performance, the ASX200 has struggled to gain momentum. We saw multiple day-on-day gains being met with stronger single-day downfalls, which has seen the benchmark index remain flat for the fortnight. ASX shares shrunk 1.4% on Thursday 25th April due to hot Australian inflation data. It then shrunk again by 1.2% on Wednesday 1st May, tracking Wall Street who similarly got spooked by hot US Inflation data. Top performers for the fortnight were the IT and health care sectors, whilst a majority of the ASX fell, led by Energy shares which plummeted by 5.37%.

The RBA is set to meet next week, and economists are not short of speculation. Hopes have been high for no further hikes and the possibilities of rate cuts later in the year, but March CPI data, which was released last week, showed prices in Australia rose by 3.8%. This is an improvement over December CPI figures, however 0.2% higher than the economists’ forecasts. The words ‘rate hikes’ has not been used for the last few months but its beginning to be thrown around again, however there is no way of truly knowing the position of the RBA until we hear next week from Governor Michelle Bullock and her board.

International Markets:

Major index’s worldwide have resoundingly bounced back. All markets have closed the fortnight in the positives, demonstrating resilience after last fortnight which we saw the opposite happening with all the major markets finishing in the negatives. The Hang Seng Index surged a colossal 12.22% for the fortnight, off the back of global money managers who have begun rejigging their portfolios. This is due to the reassessment of the US Federal Reserve’s policy outlook given its recent results. Major funds have poured money into the Hong Kong market due to the currency’s recent performance as well as the major demand worldwide for their stocks, which has in turn driven prices higher to create the surge in the Hang Seng index.

The US has continued to be highly influential on the rest of the world’s economies. International markets are listening intently and hanging off every word of the Fed’s Chairman, Jerome Powell. The Federal Reserve announced rates were being held at the 5.25 to 5.5% per cent range, with Powell recognising that current rates were “sufficiently restrictive,” but persistent inflation means it is not yet time to start cutting rates. He dismissed speculation around rate rises, but this certainly isn’t concrete, as we have learnt by now that conditions are constantly changing.