Australians love property, why don’t we love reviewing our mortgage?

With interest rates now on the rise, many Australians may be worried about the cost of their mortgage repayments but there are some options to keep them as low as possible.

The majority of Australian mortgage holders are currently missing out on the potential of refinancing. Research commissioned by leading mortgage broker Aussie revealed that most mortgage holders (60%) were of the opinion that they were not getting a good deal, however of the 6 million active mortgages, only 445,000 have sought to find the right deal and refinanced in the last financial year.

A further 28% said they are unaware of their current home loan interest rate.

How will a rate change affect my home loan

The Reserve Bank of Australia announced a 0.25 percentage point increase to its cash rate on Tuesday. The big four bank announced they would be passing this on to their customers within 12 hours of the announcement, with the rate rises due to hit before the end of May.

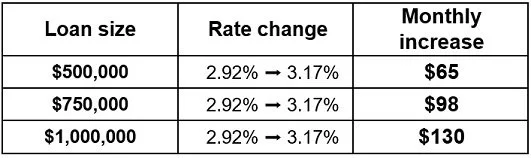

For a $500,000 mortgage this would see a monthly increase in the repayment of $65. This may seem manageable to some with the tightening of the belt and potentially not buying that second coffee, however with more rate rises expected, this could jump to $567 per month if there is a 2.0 percentage point increase – something that many experts believe could happen by mid-next year.

Additionally, according to the ABS the average mortgage size in Melbourne in November 2021 was $618,602 so the increase could be significantly higher.

Based on an owner-occupier paying principal and interest with 25 years remaining on the average variable rate of 2.92% assuming the banks pass the cash rate hike on in full.

Why don’t we all review our mortgage more often?

The number one reason is that we are all time poor and it can feel like the paperwork may never end.

Salt Financial Group has access to a panel of mortgage brokers. We can put you in touch with the right broker who will take the leg work and hassle out of reviewing your mortgage and the refinancing process. The service is generally free even if you don’t change lenders.